modified business tax rate nevada

Other indices are in use but are less popular. You might be obligated to collect that other states sales taxes and file a sales tax return there even if your primary location is in an origin-based.

Common indices in the US.

. GrantSolutions System Access and Training DOI financial assistance recipients received system access and training according to their awarding bureaus GrantSolutions deployment timeline. A Nevada corporation is a corporation incorporated under Chapter 78 of the Nevada Revised Statutes of the US. Heres another wrinkle.

Prime Rate the London Interbank Offered Rate LIBOR and the Treasury Index T-Bill. In this case the sales tax is based on the rate where the store is located. This page will be updated monthly as.

This page will be updated monthly as new sales tax rates are released. Effective July 1 2019 the tax rate changes to 1853 from 20. Your business may have a nexus in another state meaning that you have an affiliation or some other legal connection there that effectively subjects you to its tax laws.

Michigan collects a state income tax at a maximum marginal tax rate of spread across tax brackets. There are no changes to the Commerce Tax credit. Over the past year there have been one local sales tax rate changes in Florida.

Do I have to file the Commerce Tax return. Unlike the Federal Income Tax Michigans state income tax does not provide couples filing jointly with expanded income tax brackets. My Nevada business closed during the year.

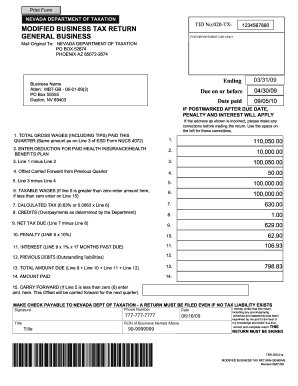

Over the past year there have been twenty local sales tax rate changes in California. This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. In the US the fixed rate mortgage term is usually up to 30 years 15 and 30 being the most common although longer terms may be offered in certain circumstances.

Michigans maximum marginal income tax rate is the 1st highest in the United States ranking directly below Michigans. If it was previously required you still need to be registered to do business with the Federal Government through the System for Award Management SAM. However if the gross revenue of your corporation exceeds 4000000 during the taxable year in the future you will be required to file a Commerce tax return for your business for that taxable year.

State of NevadaIt is significant in United States corporate lawNevada like Delaware see Delaware General Corporation Law is well known as a state that offers a corporate havenMany major corporations are incorporated in Nevada particularly corporations. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Sales Tax Sourcing becomes much more important for retailers who ship products to other locations such as online retailers and those who sell products by catalog.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. When you ship a product to another address the knowledge of your tax rules becomes very important in. Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the.

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Does Qb Offer The Nv Modified Business Tax Payroll Form

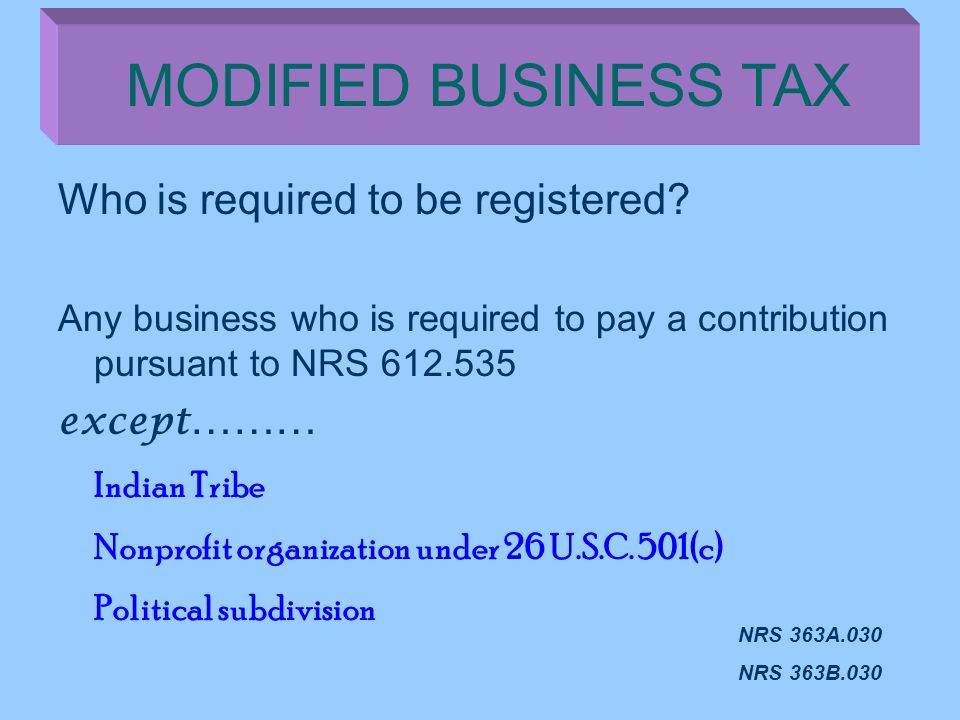

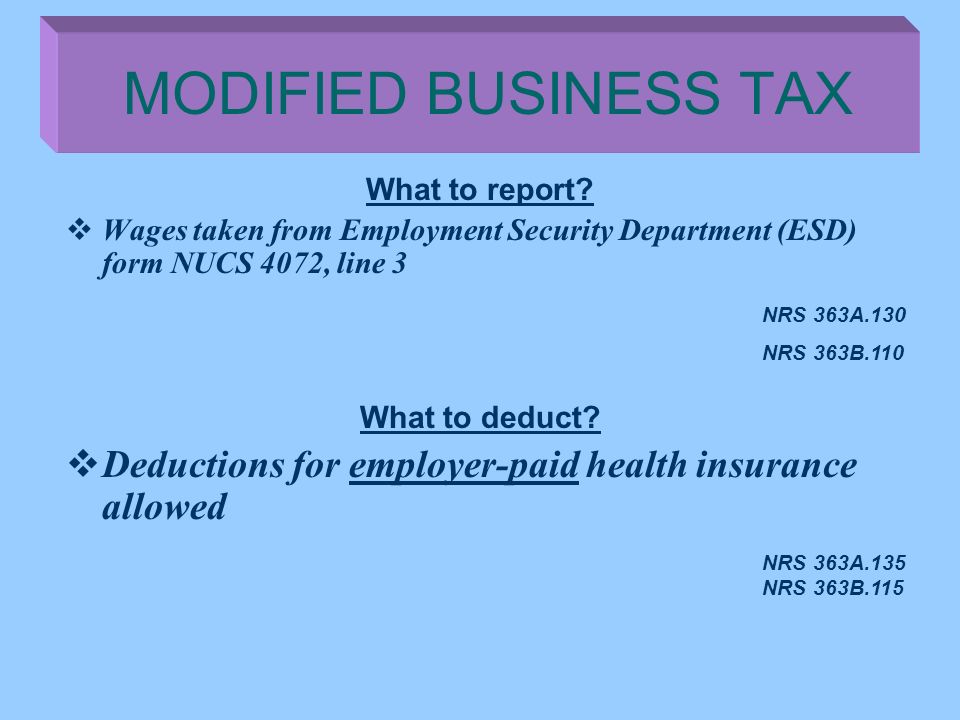

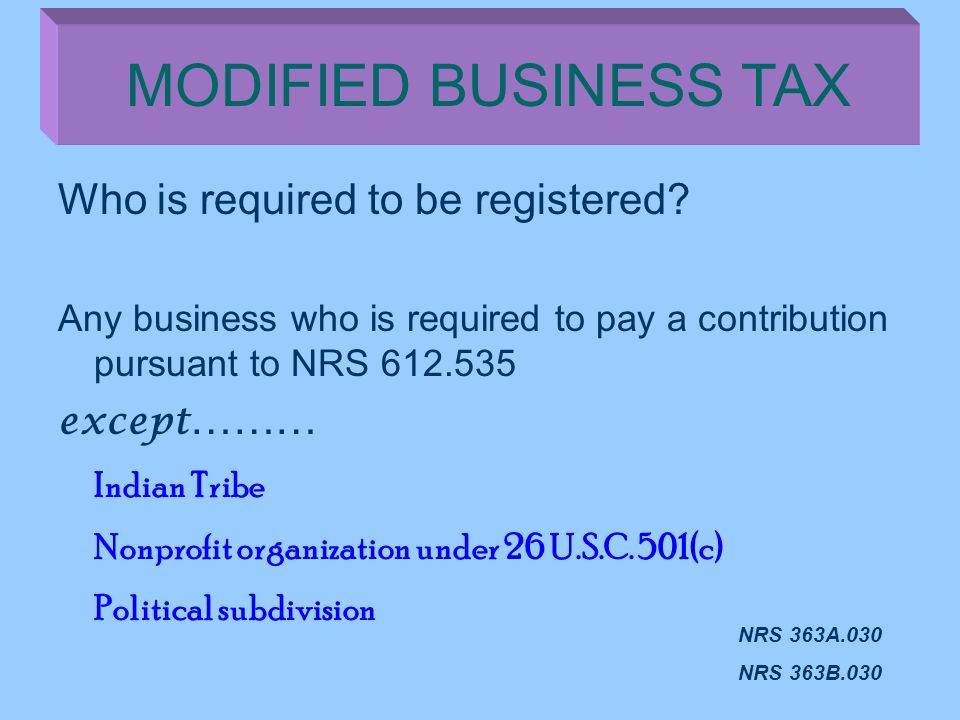

State Of Nevada Department Of Taxation Ppt Video Online Download

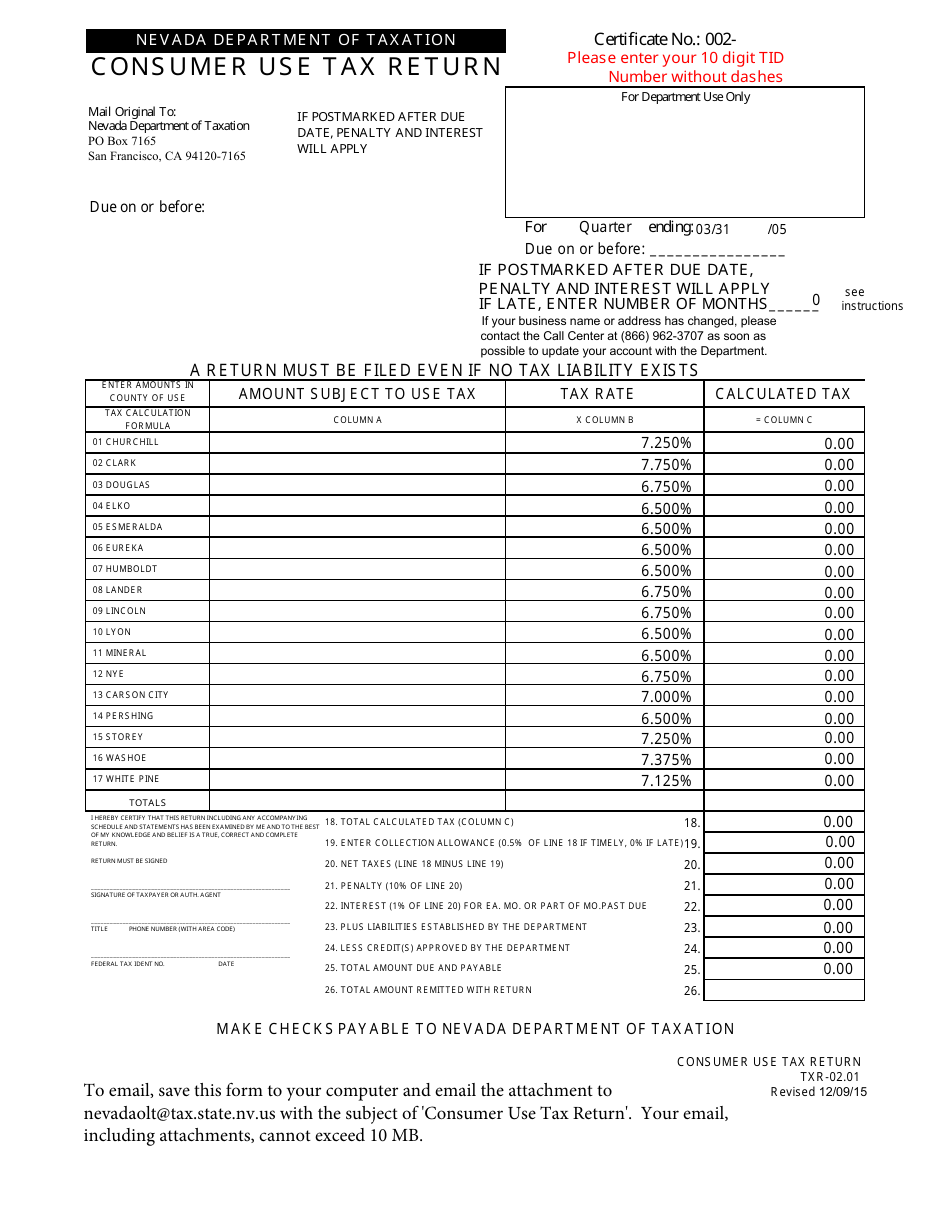

Form Txr 02 01 Download Fillable Pdf Or Fill Online Consumer Use Tax Return Nevada Templateroller

What Is The Business Tax Rate In Nevada

State Of Nevada Department Of Taxation Ppt Video Online Download

State Of Nevada Department Of Taxation Ppt Video Online Download

State Of Nevada Department Of Taxation Ppt Video Online Download

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller